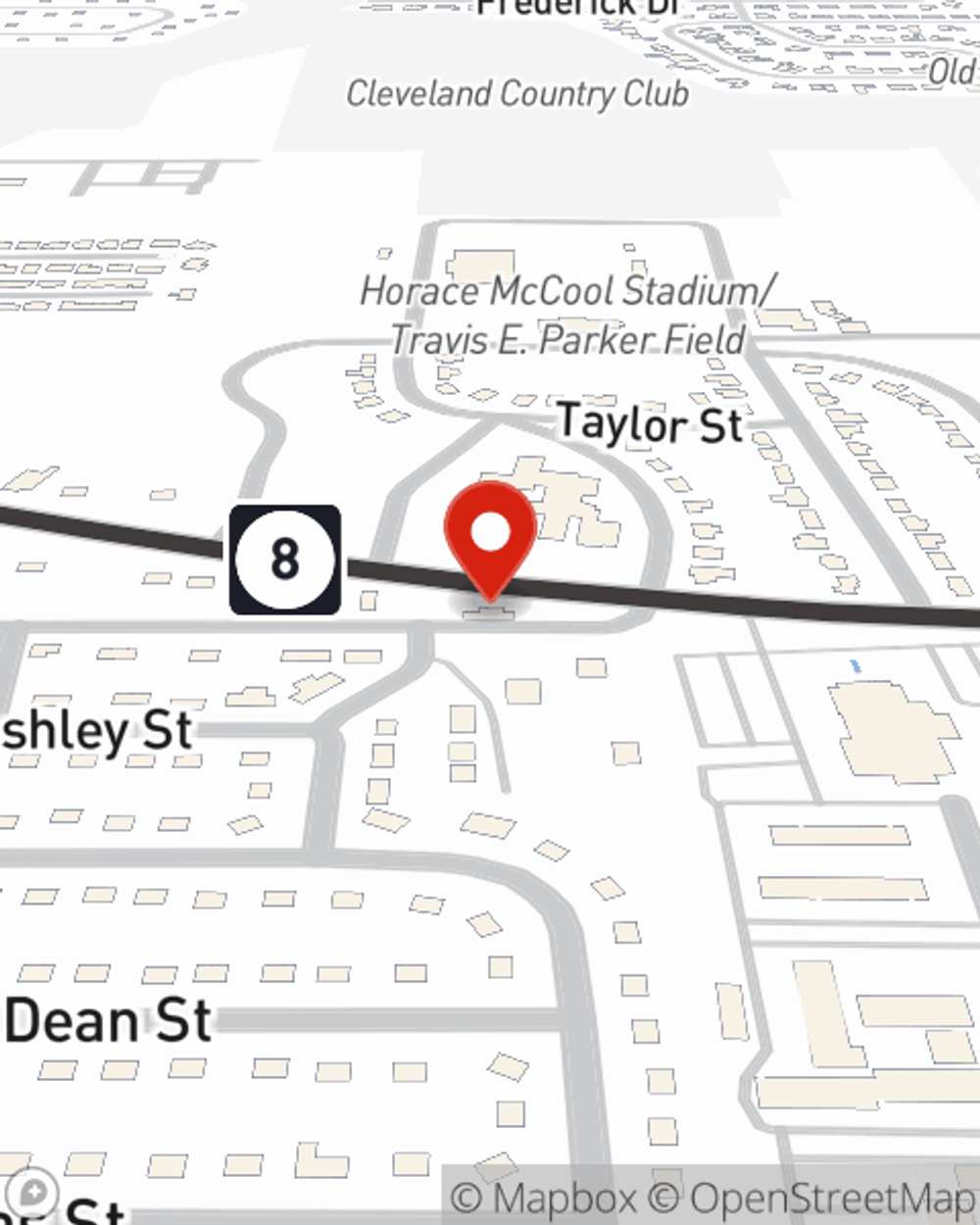

About Dan Bell State Farm Insurance

Dan Bell State Farm Insurance is a reliable insurance agency dedicated to providing exceptional coverage and personalized service to individuals and businesses in Cleveland. Led by insurance professional Dan Bell, our agency takes pride in offering comprehensive insurance options to meet the unique needs of our customers.

With years of experience in the insurance industry, Dan Bell and his team understand the importance of protecting what matters most to you.

At Dan Bell State Farm Insurance, we prioritize building strong relationships with our customers. We believe that loyalty and open communication are the foundations of a successful relationships. Our dedicated agents take the time to listen to your concerns, answer your questions, and guide you through the insurance process, ensuring that you have a clear understanding of your coverage options.

As a State Farm agency, we have access to a wide range of insurance products and services, backed by the financial strength and stability of one of the largest insurance companies in the United States. This allows us to offer flexible coverage options that suit your specific needs and budget.

Beyond insurance, our agency is committed to giving back to the community. We actively support local organizations and participate in community events to make a positive impact on the lives of those around us.

When you choose Dan Bell State Farm Insurance, you will be in good hands. We are dedicated to providing exceptional customer service, reliable insurance coverage, and protection. Contact our agency today to experience the personalized and professional service that sets us apart.

Graduation is a significant milestone in a person's life, symbolizing the completion of one chapter and the beginning of another. As graduates embark on their journey into the professional world, one aspect that often gets overlooked is insurance.

Insurance plays a crucial role in protecting individuals from unexpected financial burdens and providing them with comfort.

Auto insurance is another crucial consideration, especially if graduates plan to drive their own vehicles. Whether they purchase a new car or continue using their current one, having adequate coverage is essential to protect against accidents, theft, or damage.

Renter's insurance is often overlooked but highly recommended, especially for graduates who move into their own apartments or rental properties. Renter's insurance covers personal belongings in case of theft, fire, or other unforeseen events, and it can also provide liability coverage if someone is injured on the premises.

Life insurance may not be a priority for young graduates, but it is worth considering, especially if they have dependents or co-signers on their student loans. Life insurance provides financial protection to loved ones in the event of the policyholder's death, ensuring that they are not burdened with outstanding debts or financial struggles.

Finally, graduates should also explore disability insurance, which provides income protection in the event of a disabling injury or illness. This type of coverage can help graduates maintain their financial stability and cover essential expenses if they are unable to work.

As graduates transition into the next phase of their lives, it is crucial to prioritize insurance as part of their life goals. By understanding the various types of coverage available and assessing their individual needs, graduates can ensure they are adequately protected and prepared for any unexpected events that may arise.